The UK’s ageing population is shaping the healthcare landscape, creating a surge in demand for essential services – including health transport. With people aged 65 and over projected to make up nearly a quarter of the population by 2043, the need for reliable Non-Emergency Patient Transport Services (NEPTS) and private medical supplies transport providers has never been greater. As the NHS faces mounting pressure to meet growing patient needs, private operators play an increasingly vital role in ensuring safe, efficient, and timely transport for elderly and vulnerable individuals.

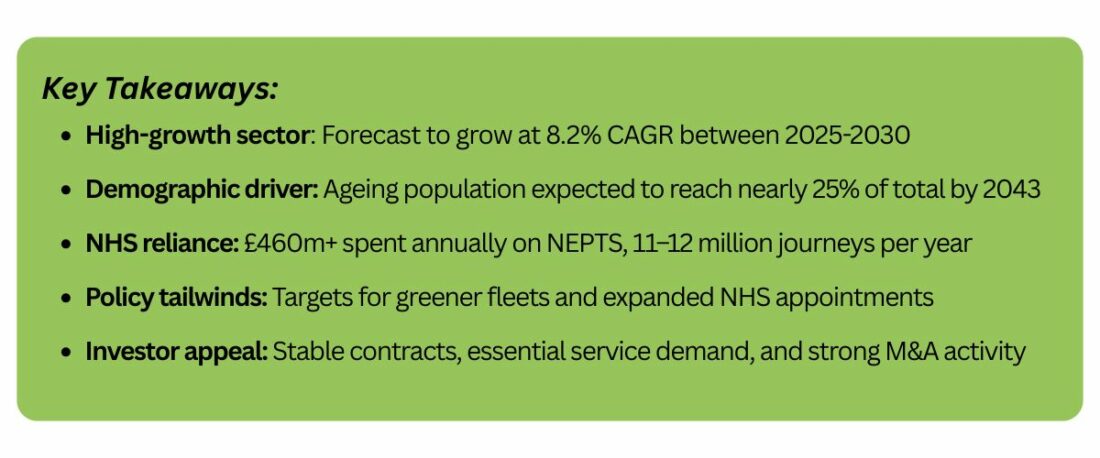

For investors and business buyers, this long-term demographic shift presents a compelling opportunity. The rising demand for patient transport services, coupled with ongoing healthcare investment, makes acquiring a health transport business a strategic and future-proof investment in the UK’s evolving healthcare sector.

This article reviews the outlook for this sector, explains some of the particular factors business buyers need to consider and why this is a good time to buy a private health transport business.

Discover businesses for sale by registering or logging in at BusinessBuyers.co.uk, an Altius Group site.

Growth and NHS Subcontracting

The NEPTS market is experiencing strong growth, increasing due to ageing populations and increasing chronic illness rates. In the UK, continued NHS reliance on private health transport services, combined with growing private healthcare demand, means the sector will continue to expand at a sustained compound annual growth rate (CAGR) of 8.2% between 2025-2030.

According to the holistic government Report of the non-emergency patient transport review in 2021, with the NHS contracting 11-12 million patient journeys made annually, covering 140 million miles, the demand for reliable, specialised transport solutions continues to rise.

Who dominates the NEPTS sector?

Private operators dominate the NEPTS sector, with the NHS spending around £460 million annually on NEPTS, with an average journey cost of £38, highlighting the growing reliance on independent providers.

Spending on NEPTS accounted for around £1 in every £275 of NHS expenditure and with the renewed focus under the Government’s policy pledge to ‘build an NHS fit for the future’ looking to add 40,000 more appointments per week, demand is set to grow.

As the NHS struggles to meet transport demands, private providers benefit from increased outsourcing. Private businesses that understand NHS procurement processes can secure long-term, stable contracts, making this an opportune moment to enter the market.

Private Health Transport Business Niches

These types of businesses provide an indispensable service to those unable to travel independently, making it a lucrative and socially impactful investment. But the private health transport sector is surprisingly diverse, with several high-growth niches:

- Renal Dialysis Transport – 35% of NHS-contracted NEPTS journeys (4.2 million each year) cater to dialysis patients who require transport to and from treatment multiple times per week.

- Outpatient Transport – 43% of NHS-contracted NEPTS journeys support patients attending medical appointments, a demand that is set to grow as the population ages.

- Hospital Discharges and Transfers – 10% of NHS-contracted NEPTS journeys facilitate patient discharges, reducing hospital bed shortages and increasing patient flow efficiency. On average, 120,000 patients are discharged from hospitals via transport services each month, in figures provided in 2020 by the Written evidence submitted by the Patient Transport Action Group. This highlights the crucial role private operators play in ensuring efficient patient flow within the healthcare system.

- Elderly and Assisted Living Transport – Mobility support for elderly residents, enabling social outings and medical appointments. With 3 out of 4 NEPTS patients aged over 65, this segment is set to expand as elderly care services receive increased government support. With the UK’s elderly population projected to reach 21% by 2030, transport services catering to care home residents will see sustained demand.

- Mental Health Transport – Specialised vehicles equipped with secure seating to protect patients and carers. Increasing government focus on mental health services is driving demand ever higher for this kind of specific transport.

- Medical Supplies Couriers – Alongside the transportation of people are supplies. Maintaining temperature controls, delivering within a defined time and secure packaging requirements.

Factors for Buyers to Consider

Compliance

Private health transport businesses must navigate strict regulatory and environmental considerations.

For compliance and licensing, businesses transporting patients must ensure their fleets and staff meet Care Quality Commission (CQC) and NHS England standards for patient transport and their varied requirements. For medical supplies transport, The Human Tissue Authority (HTA) and the Medicines and Healthcare products Regulatory Agency (MHRA) are the main organisations responsible for regulations.

When is the NHS aiming for net zero emissions?

The Carbon emissions impact of the industry is substantial with NEPTS accouning for 20% of NHS travel emissions. The NHS aims for net zero emissions by 2040, with all NEPTS vehicles expected to be zero-emission by 2035. This shift presents both a challenge and an opportunity for early adopters of electric fleets.

Investing in electric vehicle fleets can offer a competitive edge as the healthcare system prioritises environmentally friendly transport solutions. The expansion of electric vehicle charging infrastructure will also facilitate the transition to sustainable transport, making it an ideal time for businesses to adopt greener operations.

Operational Navigation

The profitability of private health transport businesses depends on service contracts, fleet management, and operational efficiency. Key financial considerations include:

- Fleet depreciation and maintenance costs

- Staffing and training expenses

- Route planning and fuel efficiency

- Sector-specific patient or cargo transportation requirements

Private health transport businesses must navigate fluctuating demand. With 3 million journeys cancelled or aborted annually due to miscommunication, effective route planning and booking systems can help mitigate these inefficiencies and improve service reliability.

A crucial aspect of financial sustainability is the Healthcare Travel Costs Scheme (HTCS), with an estimated expenditure of £5-10 million annually. While designed to support patients on low incomes, the scheme’s low uptake suggests further opportunities for transport businesses to address accessibility gaps.

What are the staffing challenges for private health transport businesses?

One challenge to consider is staffing demand in the sector. The patient transport workforce consists of approximately 10-15,000 full-time staff in 2021. While staffing shortages are not widespread, skills gaps do exist, particularly in specialist transport sectors.

However, these challenges also present opportunities for business buyers. Digital transport co-ordination tools are being introduced to optimise efficiency. Additionally, the expansion of electric vehicle charging infrastructure supports the NHS’s net-zero ambitions, making sustainability-focused operators much more attractive for long-term contracts.

Why Now, Why RDK?

With NHS pressures mounting, an ageing population, and increased reliance on private sector transport, the market for private health transport businesses is thriving. The NHS’s £500 million annual spend on NEPTS, coupled with expanding NHS subcontracting opportunities, makes this a strategic time to invest.

With increasing demand for reliable transport solutions, government support for greener and more efficient fleets, and a growing market for contract-based services, acquiring a private transport business now can position buyers for long-term success in an essential and evolving industry. Entrepreneurs and investors looking for a stable, scalable business with long-term government backing should consider entering this sector now.

The sector is experiencing strong M&A activity, as operators expand their fleets and service offerings to remain competitive. With rising urbanisation and a shift towards more sustainable transport options, strategic investors who act now can secure valuable market positions and capitalise on the 8.2% CAGR.

However, buying or selling a private transport business comes with unique complexities, from fleet valuation and regulatory compliance to securing the right counterparty. Our specialist Medical sector team at Redwoods Dowling Kerr is uniquely positioned to help navigate these challenges, ensuring a seamless transaction that maximises value for both buyers and sellers of medical businesses.

Whether you are looking to acquire a thriving medical transport business or planning a strategic exit, Redwoods Dowling Kerr is here to provide industry-leading support. Get in touch with our expert team today to explore your next M&A opportunity.

Thinking of selling your business?

If you are considering selling your business and have any questions about what you may need to consider, then one of our experienced sales negotiators are always here to chat through any important points you may want to discuss.

Looking to buy a business?

Are looking to purchase a business? The RDK sales team are here to work with you. Perhaps you are considering entering a new market or expanding your presence within an existing one? Whatever stage you’re at RDK have a wealth of opportunities that may be of interest to you.

MORE FROM CATEGORY: Medical