This is an extract from the January Home Care and Supported Living Market Report.

To explore the full analysis and insights behind these findings, read the January 2026 Home Care and Supported Living Market Report, which examines the key trends shaping the sector.

Market Structure: Homecare Consolidation Gains Momentum

The homecare and supported living market is undergoing structural change, shifting from a fragmented landscape to one dominated by more organised and scaled operations. While the sector is still largely composed of single-service providers, the most significant growth is now occurring among small to mid-sized groups.

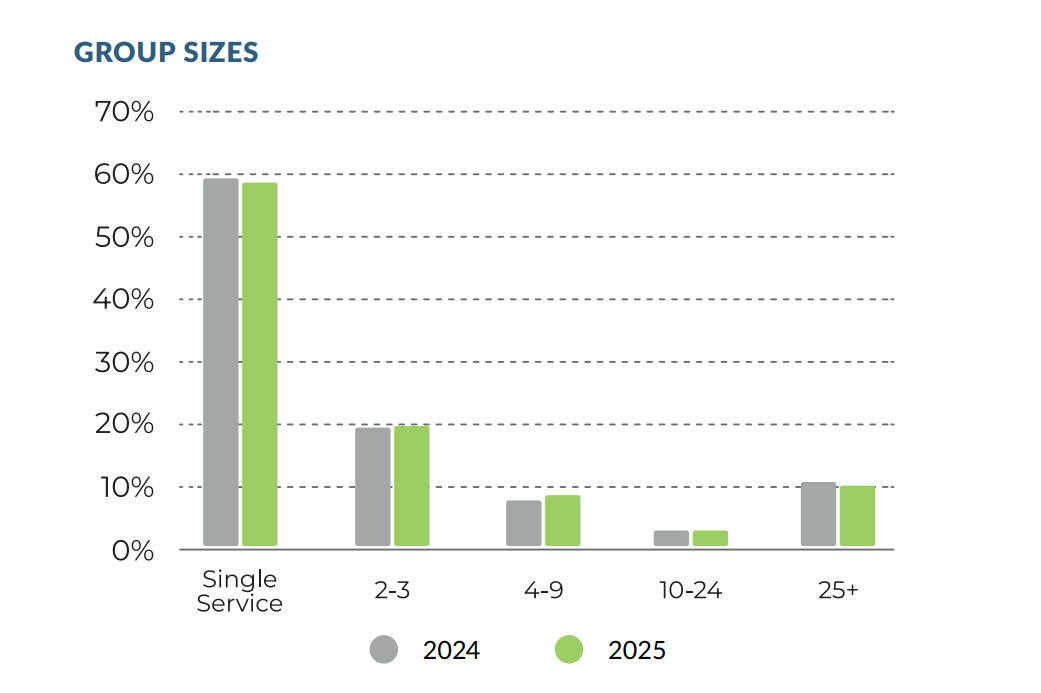

Single-service operators remain the foundation of the market, representing 58% of all providers in 2025, down from 59% in 2024. This gradual contraction reflects mounting operational pressures, as independent operation becomes increasingly challenging. These pressures include regulatory requirements, staffing demands, and the need for technology-enabled efficiency, all of which are driving the sector toward consolidation.

The strongest growth has been seen in the 4-9 services segment, which rose from 7% to 8%. The 2-3 services group also expanded, albeit marginally, from 19% to 19.8%.

Larger operators have maintained stability at the top. Groups with 25 or more services dropped slightly to a 10.3% share (from 10.6%), while the 10-24 services segment saw a slight increase. This combination of stable large operators and growing mid-sized groups indicates a multi-layered acquisition environment in which mid-sized businesses are both expanding to compete with larger players and becoming attractive targets themselves.

Within the market, it is increasingly common for providers to operate across both the Care Homes and Homecare subsectors. This dual operation allows providers to diversify revenue streams, build operational resilience, and create integrated care pathways, further reinforcing consolidation and the strategic value of multi-service operators.

Ownership Ages: A Younger Generation of Operators Emerging

The demographic profile of homecare and supported living business owners differs markedly from the wider care sector. This sector is characterised by a younger ownership base and an influx of new entrepreneurs, indicating accessible entry points for new operators.

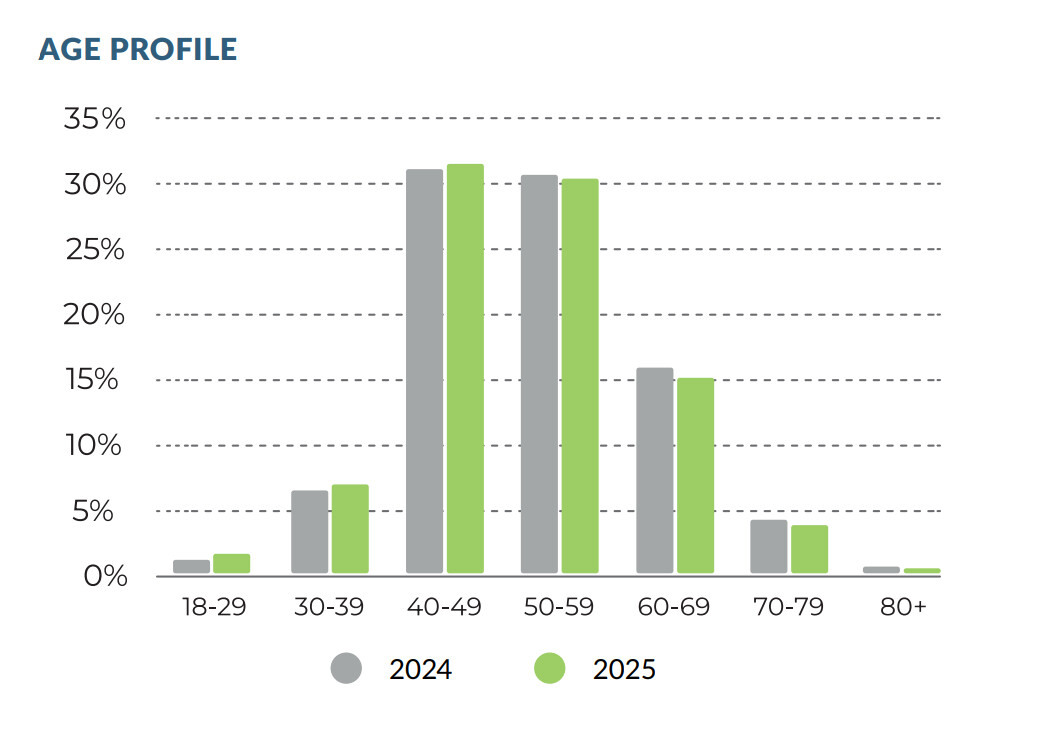

Data shows that established, mid-career operators dominate the market. The 40–49 age group is the largest cohort, representing 32.8% of owners in 2025, with the 30–39 segment accounting for 14.1%. By comparison, care home ownership skews older, with the largest cohort aged 50-59. This difference reflects lower barriers to entry and less capital-intensive operational requirements in home care.

Notably, the under 40 cohort grew from 15% in 2024 to 16.9% in 2025, a trend demonstrating the sector’s appeal to younger entrepreneurs. At the same time, owners aged 50 and over make up 50.5% of the sector, providing a consistent flow of retirement-driven exit opportunities.

*This data is a result of a blended analysis of data published by CQC, SCI, WCI and Companies House, which has been developed for MI by Altius BI. Figures do not include NI.

Market perspective and next considerations

Across the homecare sector, consolidation is increasingly influencing how providers scale and compete, while shifts in ownership age continue to create momentum for both growth and deal activity. Together, these factors are helping to position homecare and supported living as an attractive and increasingly investable market.

For further insight into consolidation trends, ownership demographics and investment drivers, access the full January 2026 Home Care and Supported Living Market Report.

Are you thinking of selling your business?

If you are considering selling your business and have any questions about what you may need to consider, then one of our experienced sales negotiators are always here to chat through any important points you may want to discuss.

Are you looking to buy a business?

Are you looking to purchase a business? Then the RDK sales team are here to work with you. Perhaps you are considering entering a new market or expanding your presence within an existing one? Whatever stage you’re at RDK have a wealth of opportunities that may be of interest to you.

MORE FROM CATEGORY: Blog