This is an extract from the Homecare and Supported Living Market Report.

RDK Announces Latest Homecare Insights Data

Redwoods Dowling Kerr is pleased to share the latest insights from our proprietary business intelligence team, Altius BI, focusing on the homecare and supported living sector, which continues to evolve.

The market is being shaped by multiple factors, including shifting consumer expectations, growing technology adoption, and ongoing consolidation. Year on year, homecare registrations have increased in volume across the UK. This can be seen in the jump from 2024 to 2025. Although many new registrations never fully progress into a fully operational business, it reflects a strong interest in the sector. These converging forces are creating an active investment landscape with clear momentum as the sector heads into 2026, offering opportunities for strategic exits, long-term investment and growth in a market that is becoming increasingly resilient and structured.

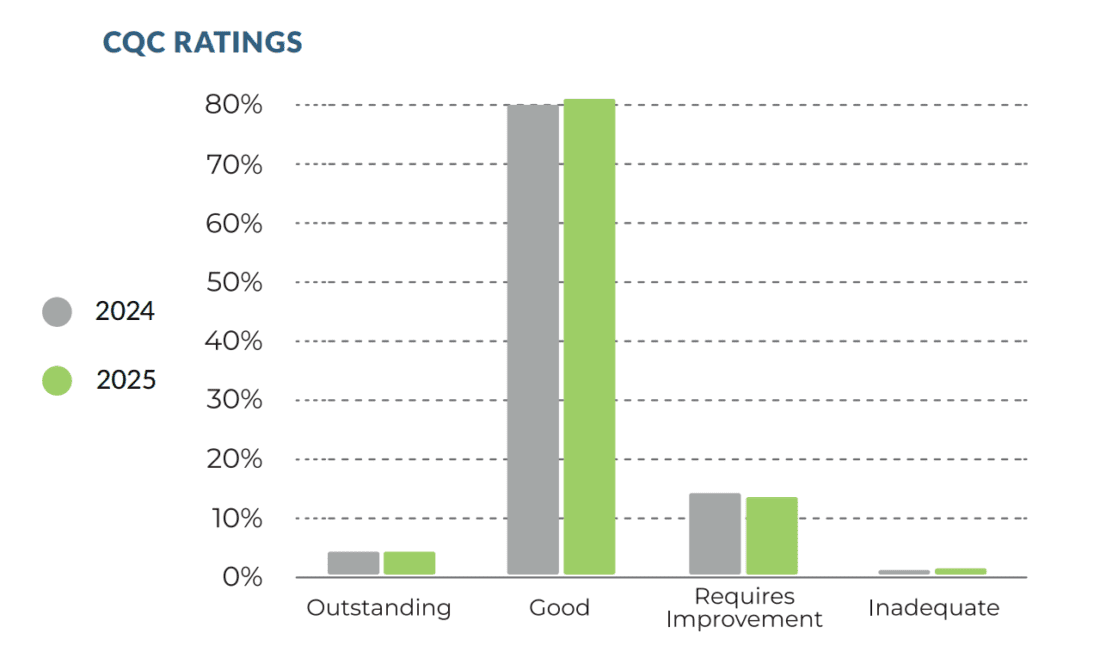

CQC Ratings: The ‘Good’ Core Increases

Recent CQC rating data for the homecare sector highlights steady improvement in quality. The proportion of services rated ‘Good’ remains the dominant standard, accounting for 81.5% of the market in 2025. Such a high baseline reflects the sector’s success in establishing widespread compliance and reliable care provision.

The most significant improvement year-on-year is in the ‘Requires Improvement’ category, which declined from 14.7% to 13.3%. For investors, this transition is important, as it enhances the overall quality profile of the sector and reduces operational risk across the market.

The ‘Outstanding’ rating remains scarce at 4.3%, continuing to represent a premium designation. Thus, overall, ‘Good’ and ‘Outstanding’ account for 85.8%, reflecting well on the sector. Conversely, the ‘Inadequate’ segment grew only slightly, from 0.5% to 0.7%.

*This data is a result of a blended analysis of data published by CQC, SCI, WCI and Companies House, which has been developed for MI by Altius BI. Figures do not include NI.

This insight highlights the strengthening quality profile and growing resilience of the UK homecare market, underpinned by rising registrations and improving regulatory outcomes.

In the next extracts of the January Home Care and Supported Living Market Report statistics analysis, we will explore how fundamentals are translating into structural change, including: market structure of providers by size, ownership ages, and ownership type.

Are you thinking of selling your business?

If you are considering selling your business and have any questions about what you may need to consider, then one of our experienced sales negotiators are always here to chat through any important points you may want to discuss.

Are you looking to buy a business?

Are you looking to purchase a business? Then the RDK sales team are here to work with you. Perhaps you are considering entering a new market or expanding your presence within an existing one? Whatever stage you’re at RDK have a wealth of opportunities that may be of interest to you.

MORE FROM CATEGORY: Blog Healthcare