The childcare sector continues to experience significant structural change, driven by evolving ownership demographics and shifting competitive dynamics. Understanding these trends is essential for operators, investors, and sector stakeholders navigating an increasingly consolidated market.

This extract presents key findings on ownership age profiles and market structure, highlighting the forces reshaping how childcare provision is organised and controlled across England.

This is an extract from the January Childcare Market Report.

To explore the full analysis and insights behind these findings, read the January 2026 Childcare Market Report, which examines the key trends shaping the sector.

Retirement Wave Accelerates Consolidation

The ageing ownership profile remains a primary driver of M&A activity. The latest figures show a clear acceleration in this trend, providing a robust pipeline of businesses coming to market as owners plan exits.

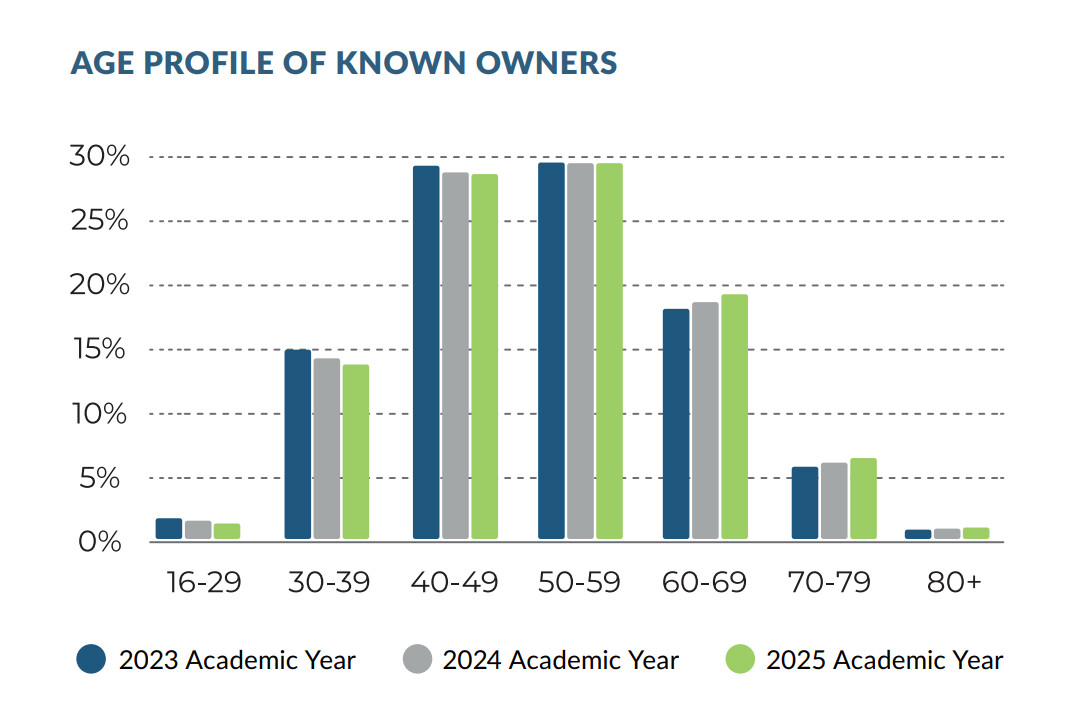

By the end of the 2024-25 academic year, 56.3% of childcare owners were aged 50 or over in England, up from 54.3% two years prior. This shift offers fertile ground for M&A as seasoned operators seek to realise the value of their life’s work.

There is a significant increase in the over-60 age range, rising from 24.9% in 2023 to 27% in 2025. Conversely, the under 40 age band have declined from 16.6% to 15.1%, reflecting steep entry challenges for younger entrepreneurs. Rising labour costs, escalating rents, and regulatory complexity make single-site operations difficult without substantial backing. This dynamic ensures consolidation remains the primary growth mechanism, benefiting mid-sized groups and corporate operators.

Consolidation: Corporate Groups Double Market Share

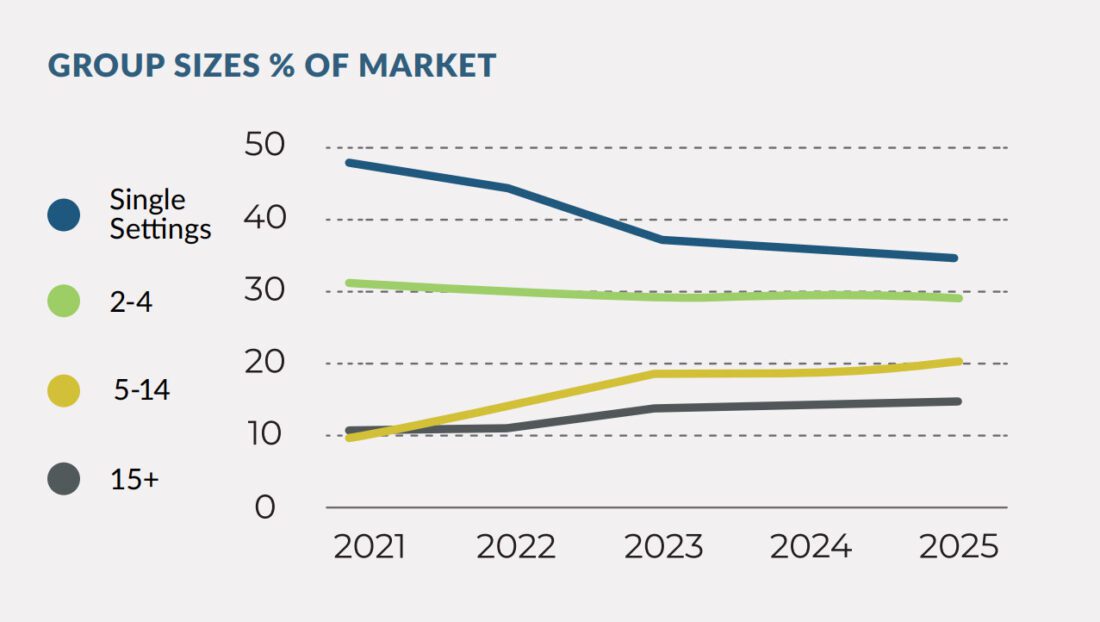

The market structure is evolving rapidly. Single-setting operators now represent just over 35% of the market in 2025, down from nearly 48% in 2021, indicating the operational challenges of running standalone sites without the efficiencies offered by scale.

The largest operators are the main beneficiaries. Corporate groups with 15+ settings have more than doubled their market share in four years, rising from 10.2% in 2021 to 20.5% in 2025. This confirms that M&A activity is shifting into significant corporate consolidation.

Mid-sized groups (2-14 settings) remain crucial, controlling 44.4% of the market, but larger 15+ groups are continuing their increase as a market presence.

*This data is a result of a blended analysis of data published by Ofsted, SCI, WCI and Companies House, which has been developed for MI by Altius BI.

Market Perspective and Next Considerations

Across the childcare sector, consolidation is increasingly influencing how providers scale and compete, while shifts in ownership age continue to create momentum for both growth and deal activity. Together, these factors are helping to position childcare as an attractive and increasingly investable market.

The next section of the January Childcare Market Report examines how scale is driving market preference and reshaping competitive dynamics.

For further insight into consolidation trends, ownership demographics and investment drivers, access the full January 2026 Childcare Market Report.

Are you thinking of selling your business?

If you are considering selling your business and have any questions about what you may need to consider, then one of our experienced sales negotiators are always here to chat through any important points you may want to discuss.

Are you looking to buy a business?

Are you looking to purchase a business? Then the RDK sales team are here to work with you. Perhaps you are considering entering a new market or expanding your presence within an existing one? Whatever stage you’re at RDK have a wealth of opportunities that may be of interest to you.

MORE FROM CATEGORY: Blog