This is an extract from the January Care Home Market Report.

To explore the full analysis and insights behind these findings, read the January 2026 Care Home Market Report, which examines the key trends shaping the sector.

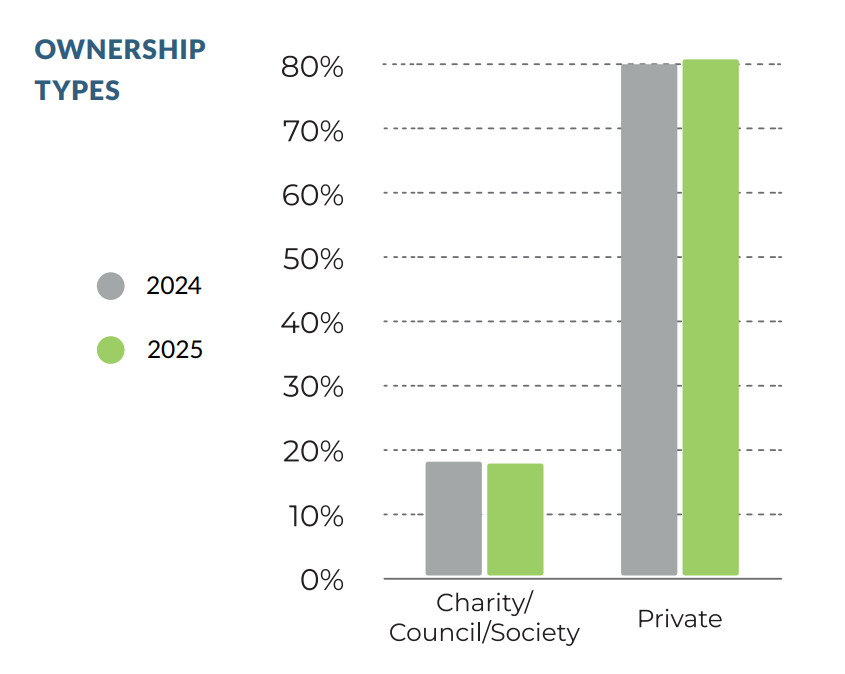

Ownership Analysis Confirms Private Sector Dominance

Analysis of the sector’s ownership profile shows a clear and accelerating trend. The market is consolidating under private ownership, and market share continues to migrate into their hands. This confirms the growing competitive pressure faced by smaller, non-corporate models.

The private sector has strengthened its dominant position. Its share of all providers increased slightly from 80.9 per cent in 2024 to 81.0 per cent in 2025. This rise, recorded during a period of overall market growth, confirms that private operators remain the primary drive behind consolidation.

Charity, Council, and Society providers declined slightly from 18.2 per cent to 17.9 per cent. This is as the market’s structural evolution continues to favour larger, well-capitalised private operators that are able to invest, scale, and compete at pace.

Although the overall trend points towards private sector dominance, there are clear regional differences. In England, Charity, Council, and Society providers represent only 16.9% of the market in 2025, while in Scotland the figure stands at 34.8%. This is more than double and highlights the distinct structural profiles of the two nations.

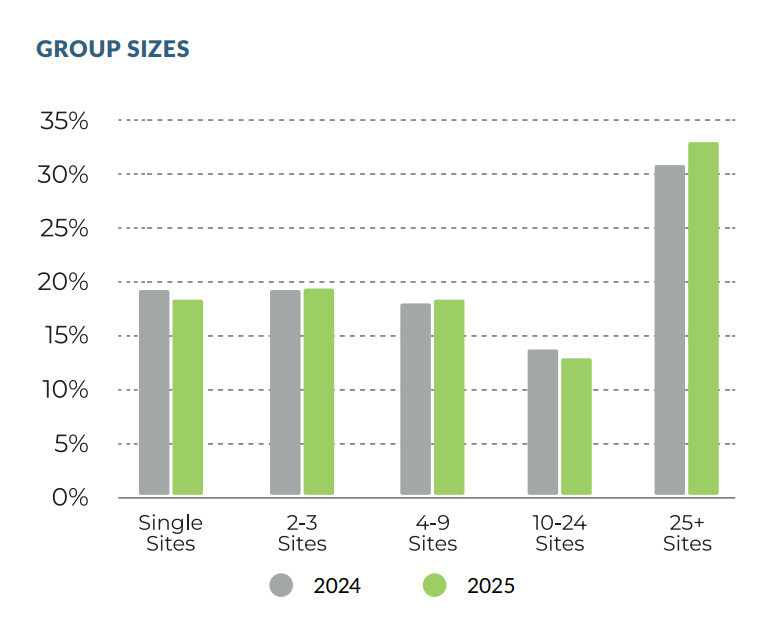

Market Structure: Large Groups Increase Market Share

Analysis of care home group sizes from 2024 to 2025 shows a clear and accelerating trend towards market consolidation, with the largest operators steadily expanding their footprint.

The most notable shift is the continued growth of the largest corporate groups. Operators with 25 or more homes increased their market share from 31.2% in 2024 to 32.8% in 2025, a gain that reinforces the market’s dominant force. This growth has been driven by acquisitions and new developments, reflecting the need to achieve national scale.

At the same time, the smallest operators have seen their share decline. Single-home providers fell from 19% to 18% over the same period. This trend highlights the growing pressures on standalone homes, which often struggle to absorb rising wage costs and navigate complex regulatory requirements without the advantages of scale.

The mid-market segments present a more nuanced picture. Operators with 2-3 homes remained largely stable, experiencing a slight decrease from 18.8% to 18.6%. The 4-9 homes group held steady with a marginal increase from 17.8% to 18%, suggesting these providers are active participants in consolidation both as acquirers of single homes and as potential targets for larger groups. Meanwhile, the 10-24 homes segment saw a decline from 13% to 12.4%.

For the M&A landscape, this redistribution of market share is significant. The ongoing reduction in single-home operators provides a steady pipeline of acquisition opportunities, while the growing dominance of the 25+ segment, now controlling nearly one-third of the market, demonstrates that scale is essential for long-term competitiveness.

*This data is a result of a blended analysis of data published by CQC, Scotland CI, CI Wales and Companies House, which has been developed for MI by Altius BI. Figures do not include NI.

Market perspective and next considerations

Across the care home sector, consolidation is increasingly influencing how providers scale and compete, while shifts in ownership age continue to create momentum for both growth and deal activity. Together, these factors are helping to position care homes as an attractive and increasingly investable market.

For further insight into consolidation trends, ownership demographics and investment drivers, access the full January 2026 Care Home Market Report.

Are you thinking of selling your business?

If you are considering selling your business and have any questions about what you may need to consider, then one of our experienced sales negotiators are always here to chat through any important points you may want to discuss.

Are you looking to buy a business?

Are you looking to purchase a business? Then the RDK sales team are here to work with you. Perhaps you are considering entering a new market or expanding your presence within an existing one? Whatever stage you’re at RDK have a wealth of opportunities that may be of interest to you.

MORE FROM CATEGORY: Blog